Why You Don't Need to Buy a Home

Living Someone Else's American Dream May Come at the Cost of Your Own

I bought my first house back in 2017. I was 27 years old, and was probably the first (or one of the first) of my friends to buy a home. Not only was I a homeowner, I had a place in one of the coolest neighborhoods in Portland (link here)! I worked at a real estate investment company at the time, but if I’m being honest I had no clue what I was doing. Academically, I knew what an interest rate was but did not know how it applied to my home loan or what my monthly interest rate/payment would be. I also vividly remember buying the place and then discovering that there was a monthly $450 HOA fee, “oh what’s this thing?” Not exactly a minor expense.

Truth is, I didn’t give a shit. I was making really good money for a 27 year old, and now everyone knew how awesome I was because I OWNED (Ha! Renters! Have fun with that!) a house in the middle of Southeast Portland. Plus, I got a deal on it (I think around 350-360k, but don’t recall exactly) by buying it through a foreclosure. I had it all figured out!

Fast forward to 2021. I knew I wanted to move out of Portland, although I didn’t know I’d be moving to NYC yet. I had also learned A LOT more about how the math around housing works. Between the mortgage, property taxes, insurance, and HOA the place was actually a money suck and wasn’t serving my long term investment (or life) goals. Oh, and don’t forget repairs. So I listed it for sale. After a few price cuts (I priced it way too high initially, because of course it was MY house so it HAD to be worth a premium) it sold for 380. Take out realtor fees, closing costs, etc and I lost significant money on the deal.

This is not to say it wasn’t a worthy “investment.” It provided me an awesome place to live in arguably the best neighborhood in Portland. I made tons of great memories there as well. It just wasn’t an “investment” from a numbers standpoint. Speaking from a strictly monetary perspective, I would have been much better off renting for those 4 years and investing the money I was spending on the condo elsewhere.

Is Owning a Home Really Part of the “American Dream”?

Housing is religion in our country. It is and has always been part of the American Dream, or at least we’ve been told that. There’s a sense that you’ve “made it” when you buy a home, and that if you’re renting you’re somehow falling behind. Frankly, the marketing around housing is genius. Nothing will get people to spend money more quickly than getting emotions involved, and nothing fires up emotions more than making people feel inferior. Keeping up with the Joneses in action.

The problem is, we often get caught up in living someone else’s American dream as opposed to our own. I say all of this as someone who directly benefits from people thinking they HAVE to own instead of rent. After all, I own a lot of rental real estate (more on that later) and when people feel pressure to buy it drives housing prices up and makes my properties more valuable. Basic supply and demand principles.

But If I Rent Am I Missing Out on Building Equity?

Aside from these appeals to emotion, the most common argument that is made for buying a home is that if you are renting you are not “building equity”. This is true in some sense, a renter does not build equity in their home. The part that they don’t tell you is that many owners aren’t building much equity either.

For purposes of this article, I used a home purchase price of $420,800 (the median purchase price in America as of the end of Q1 2024). I also used a 7% mortgage rate, which is the level we’ve been hovering around. Lastly, I assumed a 6% down payment (The average first time buyer puts down 6%).

Head spinning? Here’s a recap:

-$420,800 purchase price

-7% rate on a 30 year mortgage

-$25,250 down payment (6% of purchase)

-$420,800 purchase price -$25,250 down payment = $395,550 mortgage loan

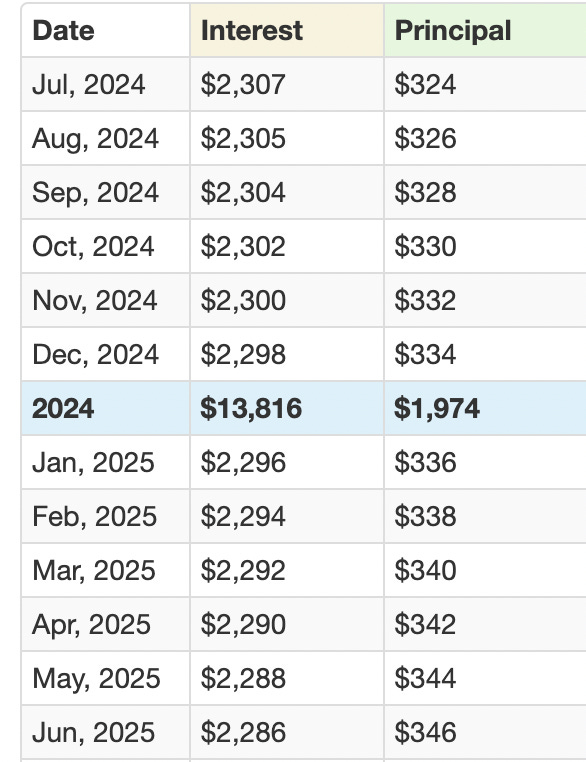

In this scenario, below are your monthly payments in the first year of your loan. Yes, you’re reading that correct. You are paying almost EIGHT TIMES as much in interest as you are toward the principle (ie “equity”). Oh, and I didn’t even include closing costs here, which are significant. On your first payment, you paid the bank $2,307. You paid yourself (your equity) $324.

“But wait! This is just year one! You eventually build equity!” Want to take a guess as to when your payments reach a point where more is going toward principle than interest?

That’s right, it’s August of 2044 when you are finally paying yourself more than you are paying the bank. You won’t be in your house in 2044. The average American lives in their home 12.3 years, but this number is skewed by boomers who typically are empty nesting and have settled down in their “dream home” and aren’t experiencing many life changes. Based on a few sources, millennials typically stay in their home for only 6-7 years (or only 4 if you’re 27 year old Matt!). The reasons for this are obvious, younger people have more life changes. People move because they have kids, change jobs/cities, or simply want to upgrade.

On top of all of this, the average annual property tax payment is $2,459. The average insurance payment is $1,915. As far as repairs, estimates vary but $3,000 is a decent average. Tack on HOA if applicable. And you’ll even get to pay a few hundred bucks a month in mortgage insurance if you put less than 20% down. Do any of these items “build equity”? Meanwhile, if you’re a renter you pay NONE of these. Speaking of rental real estate…..

Is Owning Rental Real Estate Different Than Owning Your Own Home?

As mentioned above, I own a lot of rental real estate and am continuously buying more. So why am I telling you all of the reasons you may NOT want to buy a home? There’s an important distinction: When you are a homeowner, you pay all of the items listed above. When you are a landlord, your tenant essentially pays for them via the rent payment. You are actually building that beloved “equity” on someone else’s dime.

This feels like the right time to add this disclaimer: You cannot simply throw a dart at a map, buy a property, rent it out, and print money. You need to run your numbers, know how to manage, find tenants, etc. Most people should not be landlords, I’m just using this example to make a point. Being a landlord is a headache, but there are definitely significant rewards if done correctly. Ok, enough on that. “Landlord 101” requires it’s own blog.

But Why Would I Want to Help My Landlord Get Rich?

“But Matt, you just said that the renter is paying for the landlords expenses! So I’m helping the landlord build equity and get rich? Doesn’t that make me a sucker?”

Here’s a question for you: Do you go to a restaurant and pay for food and complain about “making the restaurant owner rich?” Of course not. The restaurant is providing a service and you are paying for said service. A home is no different. Service is provided. You pay for said service. Landlord makes money. You get a place to live. Everyone wins. Not everything is a zero sum game. The landlord getting rich does not make you less rich. Run your own race.

The Benefits of Renting

I rent my place here in New York. People are sometimes confused when I tell them I own a bunch of rental properties, yet rent the place I live in. Here are some of the benefits I enjoy:

-Granted New York is an extreme market due to various factors, but if I owned my apartment instead of rented it I would pay minimum double what I pay for rent. New York (Manhattan in particular) is an extreme example, but it is more expensive to rent than own in 34 of 35 major US metros at the moment. In most of them, the difference is significant.

-When something breaks I call the landlord and they fix it. I don’t pay for it. I don’t have to find a contractor. I just go about my day and someone handles it.

-If I want to move to a new neighborhood, I just move. I don’t have to deal with any of the hassle + costs of a sale.

So Should I Rent or Buy?

The Rent vs Buy debate is one that is old as time, or at least as old as houses. Buying has long been associated with “making it” and the “American Dream”. “I rent” is often met with a pat on the back and a “you’ll get there some day bud.” Like most things, it’s not a cut and dry answer. Buying vs renting is a deeply personal decision based on family dynamics, how long you think you are going to live there, and of course….the numbers.

I am not here to tell you that one is right and that one is wrong. What is right for me may be wrong for you, and vice versa. One piece of guidance that I will give: If you are going to buy, do it because it’s the right thing for you and your family. Don’t do it because society tells you that you have to or because you are falling behind if you don’t (trust me, you’re not. Tons of very wealthy people rent). Treat it as a place to live and make memories, not as an investment. If you get a run up in housing prices like we’ve had the last few years and end up making money? Great! But treat that as the cherry on top. Oh, and you can also feel cool telling your friends about your purchase, just like 27 year old Matt.

Smart stuff as always from the Sauce Town Guy!!!